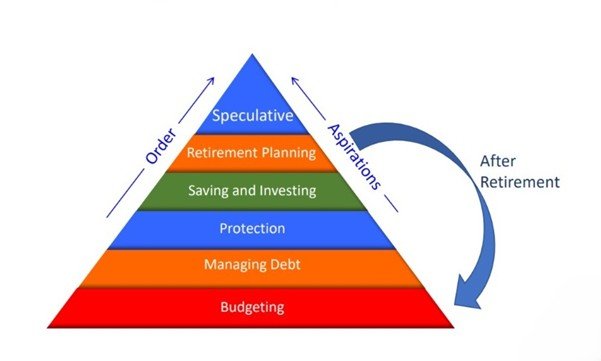

The Financial Planning Hierarchy

The Financial Needs Hierarchy is a visual representation of the fundamental rules of financial planning. It outlines a structured approach to managing your finances, prioritizing certain needs over others. By following this hierarchy, you can create a solid financial foundation and work towards achieving your financial aspirations.

Budgeting is at the base of the hierarchy. This is the cornerstone of financial stability. Before addressing any other financial need, it’s essential to have a clear understanding of your income and expenses. Budgeting helps you track your spending, identify areas where you can cut back, and allocate funds toward your financial goals.

Once you have a solid budget, the next step is Managing Debt. This involves paying off high-interest debts promptly and avoiding unnecessary borrowing. Debt management is crucial because it frees up your income and improves your creditworthiness.

The third layer of the hierarchy is Protection. This refers to safeguarding your financial future against unforeseen events. It includes obtaining insurance coverage, such as health insurance, life insurance, and property insurance, to protect yourself and your assets from financial losses.

Once you’ve established a budget, managed your debt, and obtained adequate protection, you can start Saving and Investing for your future. This involves setting aside a portion of your income regularly and investing it in various financial instruments, such as stocks, bonds, or mutual funds, to grow your wealth over time.

The fifth layer of the hierarchy is Retirement Planning. This is a long-term financial goal that requires careful planning and disciplined saving. Retirement planning involves estimating your future income needs, determining how much you need to save, and investing your savings in a way that will provide a comfortable retirement.

Finally, at the top of the pyramid is Aspirations. This represents your personal financial goals and aspirations, such as buying a home, starting a business, funding your children’s education, or pursuing hobbies and passions.

The financial needs hierarchy emphasizes the importance of prioritizing your financial needs. By starting with the foundational aspects like budgeting and debt management, you can create a solid foundation for your financial future. Remember, the hierarchy is a guide, not a rigid rule. You can adjust it to suit your circumstances and financial goals.

Click here to Get Your Free Wealth Checkup! OR Visit: www.yourwealthwisher.in

This free checkup shows you:

- Your current financial situation

- What you might need in the future

- How insurance and smart investments can help